French manufacturing services provider Sculpteo has published the eighth edition of its annual State of 3D Printing Report.

This year's analysis focused heavily on manufacturers' views on the eco-benefits of 3D printing, with around 41% of contributors agreeing that the technology helps them achieve their sustainability goals. Among other issues such as barriers to implementation, costs and the future of the industry, respondents also voiced their opinions on recycling, with around 63%s saying they are looking for ways to reuse waste parts.

"This year we decided to focus on a major issue that concerns all sectors of the industry and something that we ourselves see as a big challenge: sustainability," said Alexandre D'Orsetti, CEO of Sculpteo. "I'm happy to say that this technology has a very bright future and I'm proud to be able to contribute to the future of 3D printing."

A survey of the state of 3D printing

Each year, Sculpteo collects industry data through a survey, which it then analyzes and uses to highlight key trends in 3D printing. Of just under 1,000 respondents to the firm's 2022 survey, 63%s came from Europe, while 23%s were based in the US. The report also found that senior managers, engineers and designers are the most likely to use the technology and its level of maturity is "increasing across the industry".

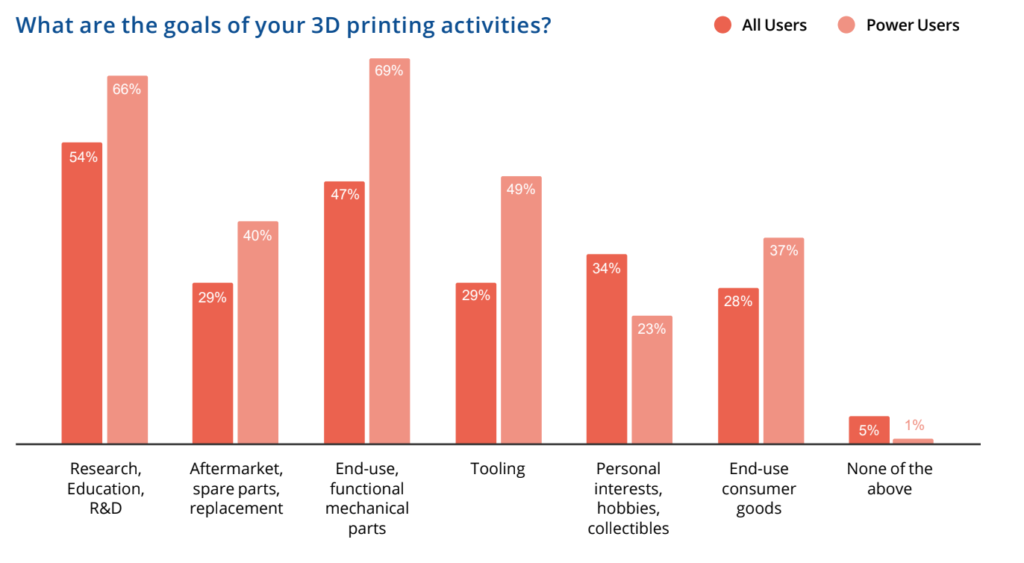

In fact, many collaborators now view 3D printing as a stand-alone manufacturing tool. About 40% of the so-called "power users" say they use the technology to do short series production runs, and 18% of those manufacturers use it for mass production. Elsewhere, 47% of respondents said they use 3D printers to create mechanical parts, while 28% use them to make consumer goods.

When it comes to sustainability, 40% admitted that they wish for more sustainable manufacturing methods and materials, but the report showed results that suggest 3D printing is making an impact in this area. 61% of the respondents agreed that the main advantage of the technology is production on demand, something that practically helps to eliminate costs and waste caused by overproduction.

Another key trend that emerged from Sculpteo's research was the positive attitude of consumers towards the potential of additive manufacturing. 84% of respondents said they were optimistic about the future of the technology, with 58% of respondents "very optimistic" that it will play a significant role in the wider world of manufacturing moving forward.

Currently, 24% of respondents use 3D printing to accelerate product iteration, with part optimization and manufacturing flexibility being the next most popular applications, with 14% and 11% respectively. In terms of technology, PBF and FDM also emerged as the most used processes with 12%, but more (49% vs. 23%) used the latter for internal needs.

In addition to finding that manufacturers were positive about the sustainability benefits of 3D printing, the study ultimately revealed that the 35% needed more support to get the most out of it. Other areas identified as needing improvement include raw materials and software, with the 35% requiring more specialized materials and the 31% agreeing that software advances could unlock additional applications.

3D Printing Research

Sculpteo is not the only one that conducts surveys to uncover the latest trends in the industry. The results of the 3D Printing Industry's own survey on the state of resin were published in June. They showed that manufacturers prioritize product availability and open material systems when making purchasing decisions.

In the past, the Sector Skills Strategy in Additive Manufacturing, or the 'SAM' project, has also seen the launch of 3D printing workforce studies designed to help deliver better training, while much of the industry itself has introduced its own additive manufacturing services to new areas.

In September 2021, for example, a Protolabs Time to Decision study was published, revealing that 83% oil and gas firms are considering introducing on-demand manufacturing for spare parts. Thus, the report says the industry needs to cut costs, reduce CO emissions 2 and to adapt to the "green energy transition".

0 Comments